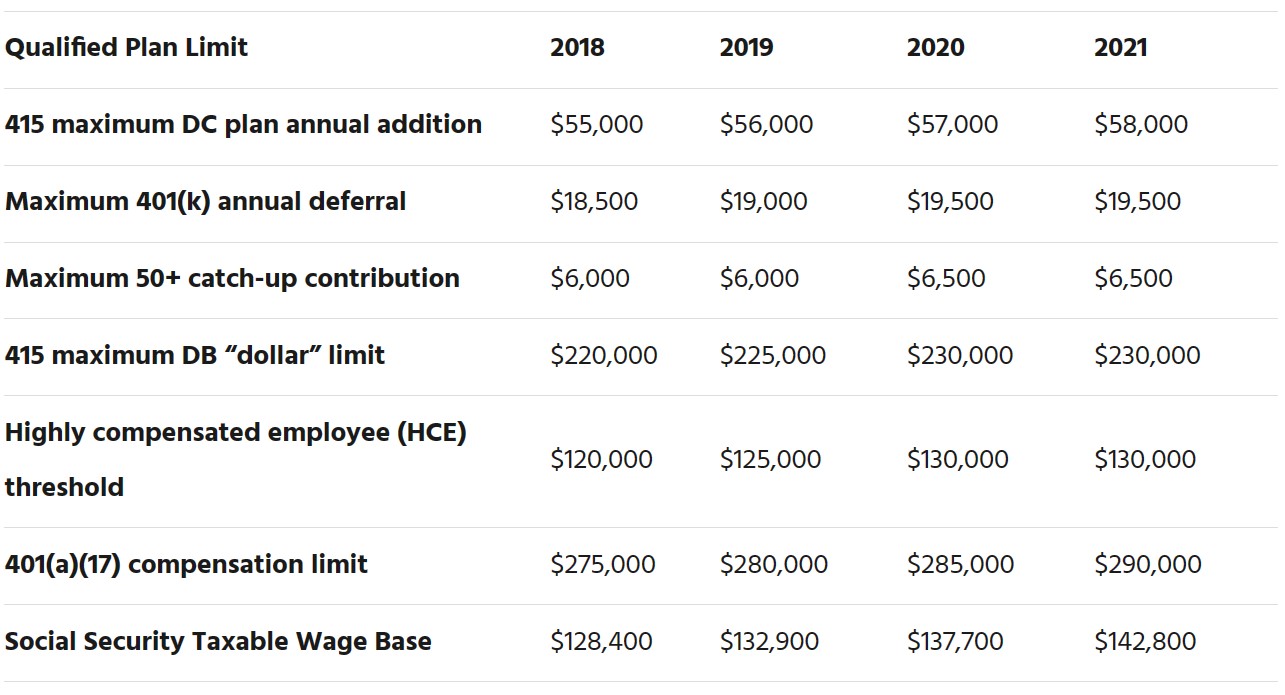

IRS Notice 2020-79 just announced the 2021 retirement plan benefit limits and there are minimal changes since 2020. However, even static IRS limits have implications for employer-sponsored retirement plans. Here is a table of the main limits, followed by our analysis of the practical effects for both defined contribution (DC) and defined benefit (DB) plans.

Changes affecting both DB and DC plans

- Qualified compensation limit increases to $290,000. One of the few changes for 2021 is a slight increase in the 401(a)(17) compensation limit. This is a similar increase to recent years, so highly-paid participants will now have more of their compensation “counted” towards qualified plan benefits and less towards non-qualified plans. This could also help plans’ nondiscrimination testing if the ratio of benefits to compensation decreases.

- HCE compensation threshold remains at $130,000. This may be unwelcome news because employers may find that more participants meet the HCE compensation criteria as their pay rates increase. This could have two direct outcomes:

- Plans may see marginally worse nondiscrimination testing results (including ADP results) if there are more HCEs. It could make a big difference for plans close to the pass/fail line.

- More HCEs means that there are more participants who must receive 401(k) deferral refunds if the plan fails the ADP test.

Note that there is a “lookback” procedure when determining HCE status. This means the 2022 HCE determination is based on 2021 compensation and the $130,000 threshold.

DC-specific increases and their significance

- The 401(k) deferral limit remains at $19,500 and the “catch-up” limit remains at $6,500. Savers may be disappointed that they can’t increase their 401(k) deferrals. The silver lining is that deferrals count towards the total DC limit, so employers can increase their maximum profit sharing allocations with the higher total cap. Individuals can potentially get up to $38,500 from employer matching and profit sharing contributions ($58,000 – $19,500) if the employer maximizes their DC plan deductions.

- 401(k) “catch-up” limit remains $6,500. Participants age 50 and older are stuck with a flat $6,500 cap in 2021. This means they can effectively get a maximum DC deduction of $64,500 ($58,000 + $6,500).

DB-specific increases and their significance

- DB 415 maximum benefit limit (the “dollar” limit) stays at $230,000. After four years of steady increases, the DB §415 dollar limit has plateaued. The effect is that individuals who have very large DB benefits (say, shareholders in a professional firm cash balance plan) won’t see a deduction increase if their benefits are already limited by the 415 dollar limit.

Social Security wage base and integrated plans

- Social Security Taxable Wage Base increases to $142,800. This is a $5,100 increase from last year’s base. A higher wage base can reduce the rate of pension accruals and DC allocations for highly-paid participants in integrated pension and profit sharing plans that provide higher rates above the wage base.